Block Size Explained

Block Size Explained

This article will take a comprehensive look into what exactly the block size is, the issues that arise as the block size limit is neared, and the solutions that are currently being implemented in order to solve the block size limit problem.

What is Block Size?

A block can be thought of as a bundle of Transfers, with each Transfer needing to be validated before it can be accepted by the network. Each block has what is known as a block size. The block size is simply the maximum limit a block can be filled up with Transfers. For example, the block size currently stands at 1 MB, although it can theoretically be up to 4 MB (more on that in the article linked above). Miners can choose how much of a block to fill with Transfers. However, if a block that exceeds the block size limit is submitted, it will be rejected by the network. The intention of a block size is to prevent denial-of-service attacks on the network. If there was no block size limit, in theory, an attacker could flood the network with lots of Transfers, therefore potentially bringing the network to a halt.

Why Block Size Matters

Issues that arise from nearing the block size limit include:

- Slowdown in the network

- Higher Transfers fees

Slowdown in the network

We have seen, for example with BTC, that the more users that transact over a network, the slower it may become. One reason that can be attributed to a slowing Distributed Ledger-based network, is the block size limit. If more users transact over a network, but the block size remains static, then the number of Transfers in a block will increase, therefore resulting in the slowdown of the network as the block size limit is approached.

Higher Transfer fees

As Transfers near their block size limit, it becomes a race for a user to have their Transfers confirmed and onto the Distributed Ledger. One way of ensuring a fast confirmation time is to pay a higher Transfer fee. This means that miners (the people who confirm Transfers) have an incentive to add higher fee Transfers to the first. Smaller Transfers will therefore take hours, and in some cases days, just to confirm.

Ways to Mitigate Block Size Issues

However, potential solutions to an inadequate block size limit include:

- Increasing the block size

- Segregated Witness (SegWit)

- Dynamic block size

Increasing the block size

One very obvious solution to any issues with the block size is to simply increase it. However, the draw back to this is, it encourages centralization. Simply increasing the block size would result in higher costs of running a full on a Distributed Ledger-based network. Therefore, fewer people would be able to afford running a full node with an increased block size, thus making the network more centralized.

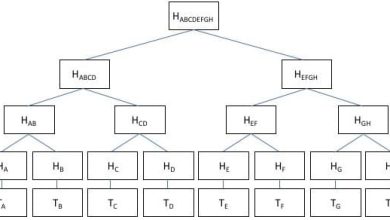

Segregated Witness

SegWit is a soft fork method that can be used to increase the capacity of the Distributed Ledger by removing signature data from Transfers. If you are uncertain about what SegWit is, check out this . Using BTC as an example, the implementation of SegWit would result in a real block size increase from 1 MB to 4 MB. Cryptocurrencies such as BTC and have successfully activated SegWit on their respective protocols.

Dynamic block size

Cryptocurrencies such as have implemented what is known as a dynamic block size limit. What this means is, the block size limit changes by itself and is dependent on the Transfer volume at any given time. A Distributed Ledger-based network that uses a dynamic block size limit enjoys the benefit of being less prone to a slowdown in its network.

Whilst this is not an exhaustive list, these are some of the main solutions currently being employed by different cryptocurrencies in the space right now.

Conclusion

Block size is a crucial factor that plays a significant role in the scalability and efficiency of Distributed Ledger networks. While increasing the block size can potentially accommodate more Transfers per block and reduce congestion, it also presents challenges such as increased resource requirements and decreased Distribution.

At the same time, keeping a smaller block size ensures a higher level of Distribution but may limit Transfer throughput.

The debate surrounding block size is ongoing, and various solutions like off-chain scaling and layer-two solutions have emerged to address the limitations of block size. Ultimately, finding the right balance between Transfer capacity and network security is essential for the long-term success and adoption of Distributed Ledger technology.

As the Digital Currency space continues to grow, scalability becomes a very key topic of discussion. It is important to understand how different cryptocurrencies intend to scale in the long-term if they are to prove a viable alternative to the current financial system.

The post appeared first on .